Banking on Us

Who we are

We are a Licensed Specialised Bank registered by the Central Bank of Sri Lanka, under the Banking Act No. 30 of 1988 (as amended by the Banking Act of 1995).

At SDB bank, our strength lies in the robust relationships we nurture with rural and underbanked communities through an extensive network of co-operative societies and Government organisations. Our network comprises 94 branches manned by a workforce of 1,475 dedicated employees across the island.

We foster socio-economic progress by improving financial literacy and inculcating sound financial habits among grassroots communities, even if we will have to witness our customers eventually migrate to mainstream financial institutions that had previously considered

them unsuitable.

Our customer base includes:

- Retail customers

- SME customers

- Co-operative societies

Our varied product portfolio provides solutions that span areas such as development, personal banking and leasing, while our deposit products encourage these communities to invest and save.

SDB bank is listed on the Main Board of the Colombo Stock Exchange. The Bank has been assigned a National Long-term Rating of BB+(lka) with a stable outlook by Fitch Ratings Lanka Ltd., and the (SL)BBB- with stable outlook by ICRA Lanka Limited.

Our rural focus is reinforced by the direct links the Bank maintains with over 8,500 co-operatives countrywide. Our rapid growth and SME-sector strength have allowed us to secure significant investment from some of the top global development finance institutions along with technical support, positioning us strongly to capitalise on these gains in the year 2020.

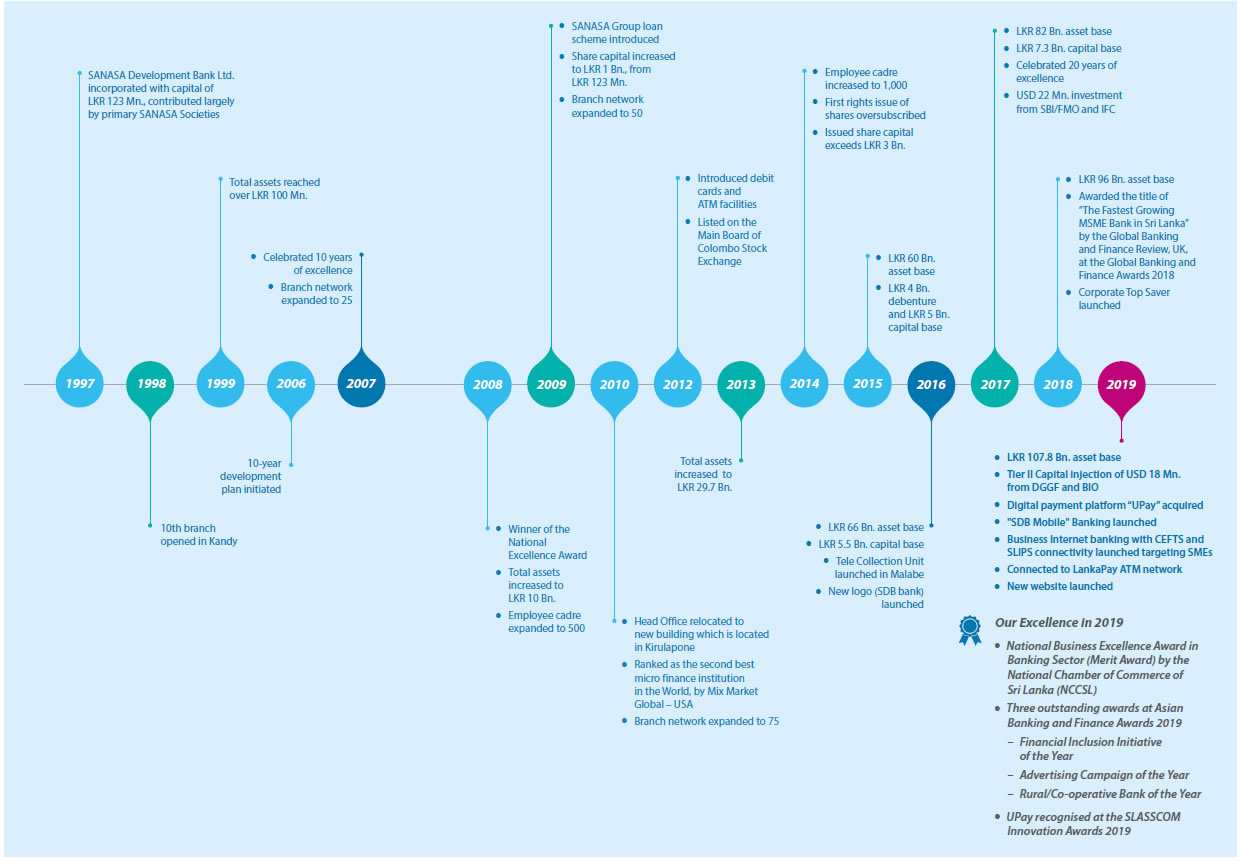

Our Journey

Since its inception up to end 2019, SDB bank’s assets have grown from approximately LKR 100 Mn. to LKR 107.8 Bn. During this time, the Bank’s geographical footprint has also expanded to 94 branches and through LankaPay we offer our customers access to nearly 5,000 ATM points covering grassroots communities across a large portion of the country. These achievements were not easily won.

Through the many socio-political and economic challenges that dotted this period of time, including 30 years of ethnic strife, recession, and of course the 2004 tsunami and other natural disasters, our services to this underserved segment of society have remained unfazed. In addition, we have focused on improving financial literacy and financial inclusion. Today we are one of the leading financial institutions for individuals, micro and SME businesses, and communities who have no other viable opportunity to realise their aspirations and improve their way of life.

Our Vision

SANASA Development Bank PLC will be the apex Bank of the co-operative sector and a leading partner of national development with a global focus.

Our Mission

By providing high quality innovative and competitive financial products and services, offered through the best customer friendly channels, assisted by cutting edge technologies, with a team of diverse talents working in synergy to provide a total solution to our stakeholders and operating in a culture of learning and continuous value creation, we strive to become the most responsible financial institution in Sri Lanka.

Our Values

- To foster and maintain the highest ethical standards at all levels of the Bank and its agencies in dealing with customers, stakeholders, and competitors.

- To be innovative and demand-driven in providing financial services.

- To be courteous and professional in all business dealings.

- To avoid discrimination on the grounds of religion, sex, ethnicity, social status, and language.

- To refrain from extending financial services for unethical and illegal pursuits.

Our Goals

- Improve the asset base to stay competitive and resilient in the market.

- Transition from a largely microfinance focus to a broader SME corporate focus.

- Establish SDB bank as the Bank of choice for the co-operative sector.

- Introduce a comprehensive digital platform to future-proof the Bank.

- Provide a delightful experience to customers through value added service.

- Maintain a highly motivated and competent team aligned with the mission of the Bank.

- Be the role model Bank for responsible finance in Sri Lanka.