Creating Value

Business activities

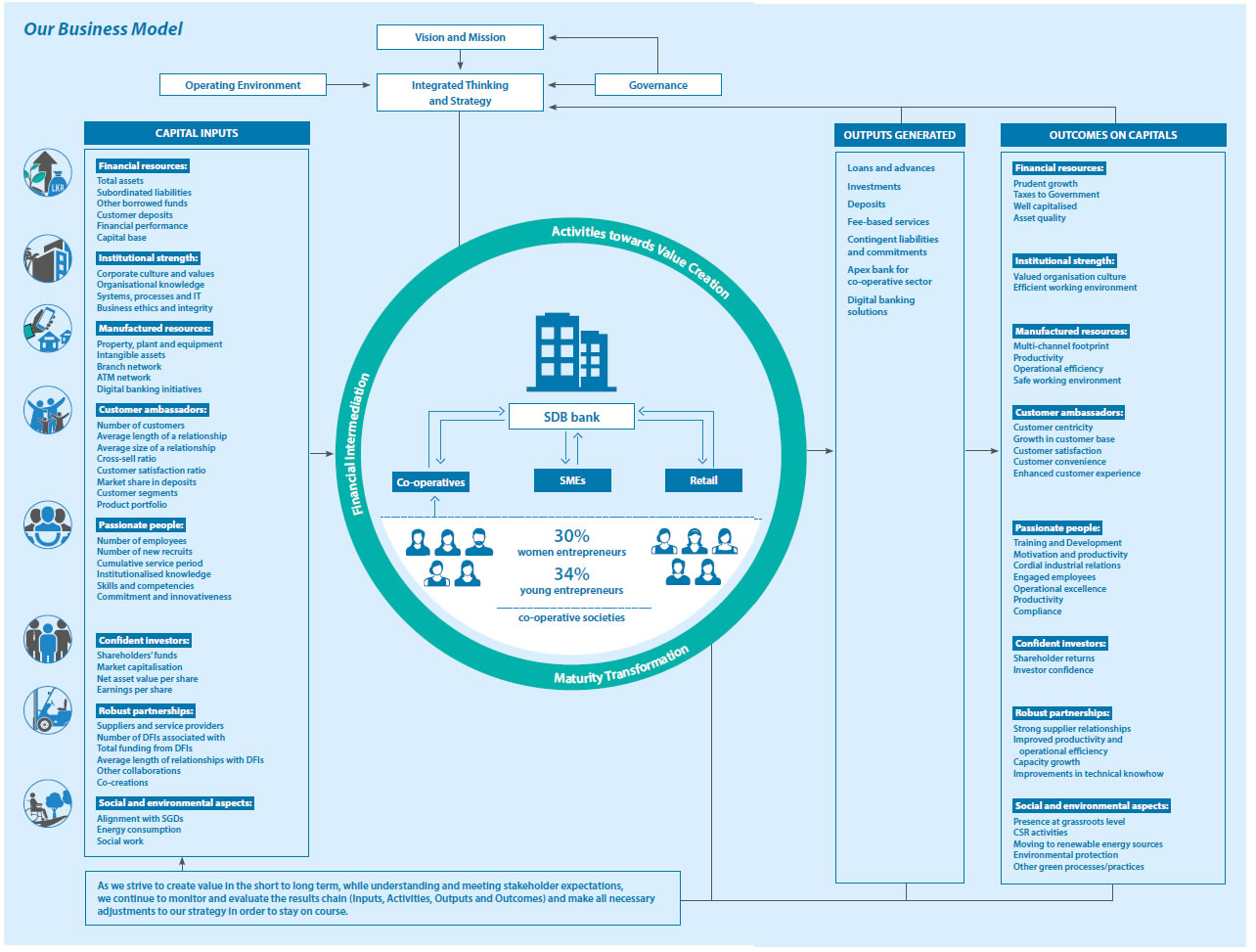

As a development bank, the primary business activities of SDB bank comprise financial intermediation and maturity transformation. Acting as an intermediary primarily between co-operative societies, the SME sector and retail customers, it mobilises deposits and lends money. The role of maturity transformation involves converting short-term funds sourced from depositors and other sources to medium- to long-term development loans as per the requirements of our borrowers.

Market segments

Retail, SME and co-operative customers are the three key market segments to whom SDB bank provides financial services. A lack of sufficient access to finances is a major impediment for them in realising their potential and contributing to the economic development of the country. The heavy emphasis on collaterals by lending institutions has made it difficult for these sectors to secure required financing. SDB bank maintains close tie up with these three market segments.

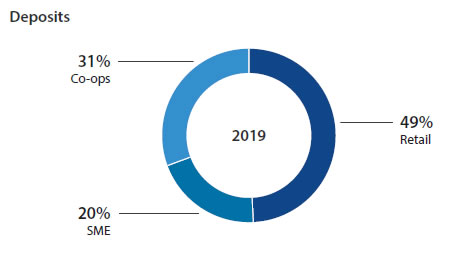

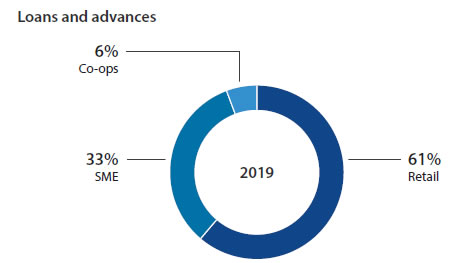

Composition of the business volumes across the three key segments as at 31 December 2019 are given below:

| Key business segment | Loans and advances

portfolio |

Deposit base % |

| Co-operative societies | 6 | 31 |

| SME sector | 33 | 20 |

| Retail customers | 61 | 49 |

SANASA Ecosystem

Operating on co-operative principles with a success story spanning over 100 years, the SANASA movement is non-partisan and non-political in service to humanity. With a bottom up management style, the SANASA Ecosystem starts at the grassroots level in villages and townships where a few individuals get together to the setting up of primary co-operative societies. Altogether there are over 8,000 such co-operative societies across the country.

All co-operative societies in a District/Zone fall under the purview of a district level co-operative society (District Union or Zonal Union). All District/Zonal Unions report to the apex body of the SANASA movement which is the SANASA Federation.

SDB bank in SANASA Ecosystem

With its roots in the SANASA movement, SDB bank is the apex bank for the entire co-operative sector comprising Co-operative Societies, Multi-purpose Co-operative Societies and Primary Thrift and Credit Co-operative Societies. Primary Co-operative Societies are one of the three distinct customer segments the Bank provides its services to. Monies that SDB bank lends to the co-operative societies are on-lent to their members while excess liquidity in co-operative societies is deposited in SDB bank. While co-operative societies take the responsibility for credit evaluation, post sanction monitoring and recovery in relation to the money on-lent to their members, it is these co-operative societies themselves that are responsible for paying back their borrowings to the SDB bank. In addition, SDB bank funds specific projects and industrial ventures of co-operative societies.

Being a Licensed Specialised Bank, SDB bank also enables the societies to access low-cost re-financing facilities available from the Central Bank of Sri Lanka.

As at 31 December 2019, 6% of the total loan portfolio amounting to LKR 5 Bn. with an extremely low non-performing loan ratio of 1% and 31% of the deposit base amounting to LKR 21 Bn. were moved to and from these societies. The Bank has been able to play a vital role in driving financial inclusion and socio-economic progress among Sri Lanka’s grassroots-level communities through its services of lending to and accepting deposits from these co-operative societies.

Promoting women entrepreneurship

With most of the members of the primary co-operative societies comprising females, SDB bank is uniquely positioned to promote women entrepreneurship in the country and in fact plays an important intermediary role. A majority of SDB bank’s agreements with most DFIs include a financial covenant that a proportion, varying from 20-30%, of funds provided should be used to support women entrepreneurs.

Sources of revenue

The Bank has reported interest and other income of LKR 15.5 Bn. for the reporting year, up from LKR 13.6 Bn. in 2018. Interest income from loans and advances represents about 89% of the total income, up from 88% in 2018. The balance 11% arose from Treasury income and fee and commission income.

Capitals

In addition to the three primary customer segments described above, a number of other stakeholders provides ‘inputs’ for the Bank to undertake its business activities and sustain its value creation and we identify all of them as “capitals” in the integrated reporting parlance. These include:

- Financial resources

- Institutional strength

- Manufactured resources

- Customer ambassadors

- Passionate people

- Confident investors

- Robust partnerships

- Social and environmental aspects

While these capitals provide the “raw materials” required for our value creation process, the outcome of the process – positive as well as negative – too is manifested in these capitals.

Gearing and risk

Financial intermediation requires and enables the Bank to operate with higher business volumes in comparison with the available capital. The underlying gearing and the maturity transformation expose the Bank to various risks such as credit, market, and operational. This is in addition to the various risks arising from certain emerging global developments that are likely to threaten the banking business model such as new technology, demographic changes leading to behavioural changes in certain stakeholder categories, growing concerns on sustainability etc. The Bank has deployed a robust risk management framework to manage all such risks underlying our business model. (refer pages 72 to 75 for more details on how we manage risks).