Governance and Compliance

Bank’s approach to corporate governance

SDB bank’s Board of Directors holds apex responsibility for implementing sound governance structures and formulating policy frameworks, thereby effectively setting the tone at the top. Governance practices are reviewed and updated regularly to reflect regulatory changes, emerging risks and opportunities and internal changes. The Bank’s ethical conduct is embodied in the oath of the Sanasa Movement, which is based on the co-operative principles of empowerment, equal opportunity, and collective participation in decision-making. The Bank’s Governance Framework has been developed to comply with several external and internal steering instruments, as listed below:

|

External instruments |

Internal instruments |

|

Companies Act No. 07 of 2007 |

Articles of Association of the Bank |

|

Banking Act No. 30 of 1988 and amendments thereto |

Board approved policies on all major operational aspects, customer chater |

|

Banking Act Direction No. 12 of 2007 of the Central Bank of Sri Lanka on |

Policy for secrecy of information, Related Party Policy, credit and other internal manuals |

|

Code of Best Practice on Corporate Governance issued by |

Integrated Risk Management Procedures Code of Conduct and Ethics for Directors |

|

Listing Rules of the Colombo Stock Exchange |

Disclosure policy, Communication policy |

|

Securities and Exchange Commission of Sri Lanka Act No. 36 of 1987 and amendments thereto |

Processes for internal controls |

|

Financial Transactions Reporting Act No. 06 of 2006 Prevention of Money Laundering Act No. 05 of 2006 Convention on the Suppression of Terrorist Financing Act No. 25 of 2005 |

Compliance Charter, Compliance Policy and procedure manual for Know Your Customer and customer Due Diligence lead to prevention of money laundering and terrorist financing |

|

Inland Revenue Act No. 24 of 2017 |

Internal circulars on operational practices |

Governance structure

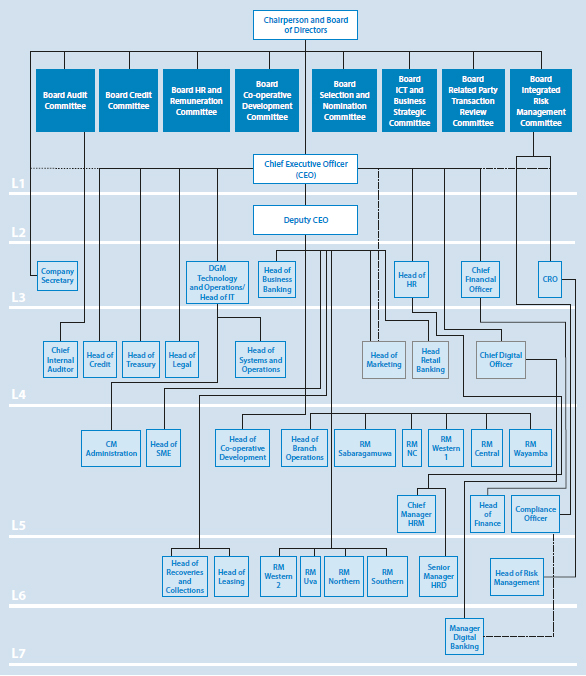

The Board of Directors hold ultimate accountability and responsibility for the affairs of the Bank. The Board is led by a Non-Independent, Non-Executive Chairperson. The Board has designated an Independent Director as the Senior Director. The Board is supported by eight subcommittees, which provide oversight and in-depth focus on specific areas, enabling the Board to dedicate sufficient time and focus to broader issues within its scope. The Bank’s governance structure is graphically illustrated below;

Board Effectiveness

Board composition

The Board comprises ten Directors, all of whom operate in a Non-Executive capacity while four are Independent. The Board of Directors submits annual declarations of independence to this effect. Directors are luminaries in the fields of academics, rural development, administration, entrepreneurship and co-operatives enhancing the overall effectiveness of decision-making. Please refer pages 18 to 21 for detailed profiles of Board members. During the period under review,

Mr B R A Bandara was appointed to the Board, Mr A P J de Vette resigned from the Board and Ms Dinithi Ratnayake was appointed in place of Mr A P J de Vette.

Diversity of skills

The Board combines diverse industry insights, skills and experience and therefore is able to assess matters from varying perspectives, enhancing the depth and effectiveness of discussions. Directors bring together academic, entrepreneurial, rural development and corporate perspectives and represent major shareholders, individuals from the Sanasa Movement and professionals from the banking industry. There is also sufficient financial acumen on the Board, with two Directors holding membership in professional accountancy bodies and several Directors holding MBAs from reputed universities.

Chairperson and CEO

The Role of Chairperson and CEO has been separated ensuring balance of power and authority. The Chairperson is a Non-Executive Director and is responsible for setting the Board’s annual work plan and agenda, ensuring that meetings are conducted effectively, with participation from all members and monitoring the overall effectiveness of the Board. The CEO’s responsibilities include, implementing strategy, monitoring and reporting the Company’s performance to the Board among others.

Appointment to the Board

A transparent procedure is in place for the appointment of new Directors to the Board. In the event of a vacancy, nominations are made through the Board Selection and Nominations Subcommittee (BS and NC). An affidavit of authenticity is required from the nominated person and the details communicated to the CBSL for Fit and propriety approval. Appointments are thereafter communicated to the CSE and shareholders through press releases. These communications include a brief rèsumè of the Director disclosing relevant expertise, key appointments, shareholding and whether he is independent or not. SDB bank has no discriminatory criteria for disqualification of nominees however BS and NC calls for nominations as per the criteria laid down by the Banking Act.

Board Human Resources and Remuneration Committee

The Bank’s remuneration for the Board of Directors and the Key Management Persons are determined based on a formal Remuneration Policy and is designed to attract and motivate professionals and high-performers. The BHRRC is responsible for providing guidance to the Board on the remuneration of Board of Directors and Senior Management within agreed terms of reference and in accordance with the remuneration policies of the Bank.

Board access to information

Directors have unfettered access to the Bank’s Management Team, who are invited for Board meetings depending on the agenda. The Management makes regular presentations to the Board to ensure that Directors are kept abreast of emerging changes in the operating landscape. Access to independent professional advice is also made available and coordinated through the Company Secretary. Directors attend seminars conducted by the Sri Lanka Institute of Directors and forums organised by the CBSL.

Board meetings

The Board convenes regularly and met 13 times in 2019; details of meeting attendance are given in the Annual Report of the Board of Directors on the Affairs of the Company on page 125. Notices of all Board meetings are given at least seven days prior to the holding of the meeting, thereby ensuring adequate time for members to prepare. Meeting agendas and Board papers are circulated to all Board members prior to the meeting. Directors are supplied with comprehensive and timely information that is required to discharge their duties effectively.

Self-appraisal

The Board and individual Directors are assessed annually for their performance and effectiveness. Each Director carries out a self-assessment of his/her individual performance as well as the collective effectiveness of the Board based on the requirements of the Securities and Exchange Commission (SEC) and CA Sri Lanka. Factors considered include Board composition, access to information, team dynamics and training opportunities among others. Going further, members of the subcommittees also assess their performance effectiveness annually.

Board subcommittees

The Board of Directors of the Bank formed mandatory Board Subcommittees and voluntary Board Subcommittees to assist the Board. The composition of both mandatory and voluntary Board Subcommittees, as at 31 December 2019 is given in the Annual Report of the Board of Directors on the Affairs of the Company on page 124.

Accountability and audit

The Board is responsible for presenting a balanced and accurate assessment of its financial performance and position. The Bank’s Financial Statements are prepared in accordance with the Sri Lanka Financial Reporting Standards laid down by The Institute of Chartered Accountants of Sri Lanka. Furthermore, the Company’s Annual Report conforms to the GRI Standard on sustainability reporting, prescribed by the Global Reporting Initiative and the Integrated Reporting Framework published by the International Integrated Reporting Council. Directors’ responsibility with regards to Financial Statements is given on page 132 of this Annual Report.

Risk management

The Board is responsible for formulating the measures, tools, processes and policies to ensure that the Bank’s risk exposures are managed within defined parameters. The Board Integrated Risk Management Committee assists the Board in the discharge of its duties related to risk management. The Bank’s risk management framework has been formulated to comply with the requirements of the Banking Act and Guidelines of the CBSL. Detailed disclosures on the Company’s key risk exposures and how they were managed during the year are given on pages 72 to 75 of this Report.

External audit

The Board Audit Committee makes recommendations to the Board regarding the appointment, service period, audit fee and engagement period of External Auditors. The Board has adopted a policy of rotating External Auditors every five years. Auditors submit Annual Statement confirming independence as required by the Companies Act No. 07 of 2007. Non-audit services are not provided by the External Auditors.

Ethics

The ethical conduct of the Bank’s employees is underpinned on the following:

- The SDB bank Code of Conduct: The Code sets out the ethical behaviour expected from employees in dealing with other stakeholders and in their day-to-day operations, as well as administrative and grievance procedures. The Code of Conduct has been formulated in line with the Monetary Board’s Customer Charter and the Secrecy Provision in the Banking Act. All employees are provided with a copy of the SDB bank Code of Conduct upon recruitment.

- Whistle-blowing Policy: The Bank has a Board-approved Whistle-blowing Policy that enables any person, including a member of staff to report unlawful or unethical behaviour while ensuring that their anonymity is preserved.