The Passion of Our People

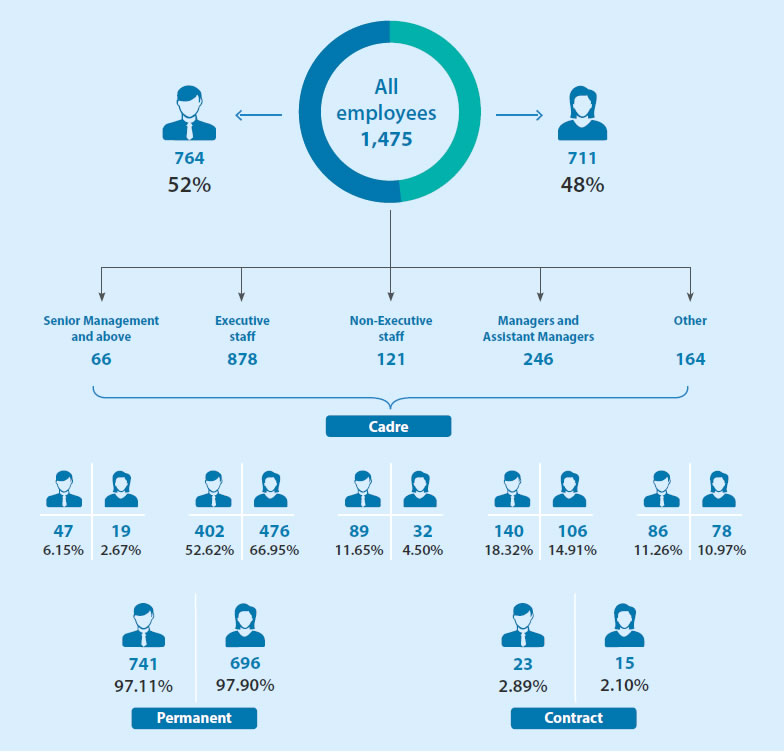

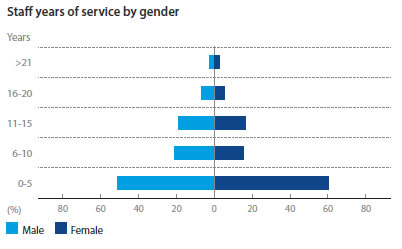

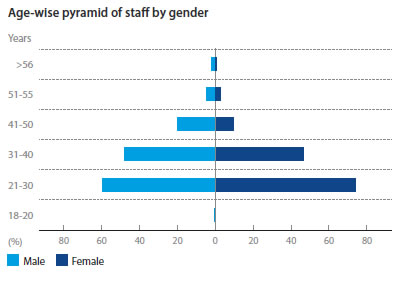

Our 1,475-strong employee cadre is the driving force that powers our value creation model. With a nearly equal 50-50 split in terms of gender across the Bank and over 97% being permanent employees, our people are as diverse as the customers they serve and solidly committed to changing the lives and lifestyles of our customers for the better. As we enter uncharted territory in which a large proportion of our customer demographic may be impacted by the COVID-19 outbreak, our people ensure that our customers receive the financial solutions they need and want. They continue to serve with commitment and compassion – ever ready to go the extra mile.

Keenly aware of how central they are to our success in delivering value to all other stakeholders, we continue to deliver value to our employees through training, development, benefits and experiences that make each individual more productive and helps each of them to contribute to the Bank’s profitability and the collective wealth of society. Our Human Resources (HR) Department, oversees recruitment, assists with workforce planning and strategy, drives the employee engagement strategy, facilitates learning and development along with succession planning, looks after the employee welfare and contributes to management decision-making through reporting and analytics.

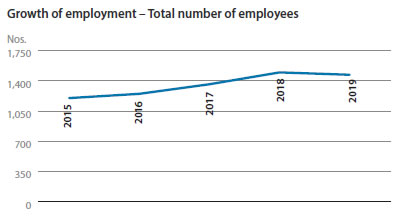

As at December 2019, the Bank had 1,475 employees. Growth in the number of employees is as follows:

Training and development

During the year under review we invested LKR 9.9 Mn. in training and development, providing employees with 2,798 hours of training across 173 sessions covering areas such as Operations, Compliance, Basel III, ICAAP, KYC, Integrated Risk Management, Marketing, Audit, IT and Secretarial.

Our forward momentum is fuelled by intangible elements such as the accumulated wealth of knowledge, talents, training, skills, judgement, and accrued experiences of our people.

The types of training opportunities we provide for our employees are threefold: internal and external training and international interactions. Our training and development strategy focuses on technical aspects and the development of soft skills – all with the goal of meeting the needs of our key market segments: SME, Retail, and Co-operative.

Technical training involves educating employees on how to identify the creditworthiness of businesses, potential areas of improvement, and prospects for income generation. Soft skills development includes how to empower customers and engender their long-term trust in the Bank. With the launch of our many digital initiatives 2020 will see us continuing to assist our people in becoming digital bankers themselves.

Employee engagement and culture

Our engagement with employees is continuous and conducted both formally and informally.

A new initiative begun during the year under review was the Great Place to Work programme in collaboration with Great Place to Work

Sri Lanka. The programme aimed to further improve the bonds between management and employees. This initiative involved an employee survey that covered employee engagement, work satisfaction, and benefits. It also consisted of a culture audit, where we did a pulse check to assess how aligned employees were with the culture of the Bank. 90% of employees participated voluntarily in this survey. Having analysed the results of these surveys SDB bank is working on an employee engagement strategy which will be rolled out in 2020.

Informal engagement mechanisms include Management visits to branches, during which proactive discussions take place with employees who bring issues to attention and make suggestions for improvement. As these alerts are brought to the Management’s attention by frontline employees who deal with customers on a daily basis the former remains appreciative and committed to taking action.

Apart from similar informal engagement methods we also utilise the following formal employee communication mechanisms:

- Bank circulars

- Emails

- Staff notice board

- Managers’ forums

Employee communication is another area that we will be looking to improve with initiatives already begun in this area during 2020.

We organise formal and informal employee events on a regional basis to improve engagement levels and cross-functional relationships. These events often combine environmental or social volunteering which serve the dual purpose of helping SDB bank to give back to the communities and environment within which it operates while also providing avenues for employees to engage informally with each other and the grassroots communities they serve. In turn such Corporate Social Responsibility projects contribute to our employees’ own feelings of self confidence and self worth.

Some key events of this nature conducted during the year under

review include:

- Christmas carols and decor competition

- Regional town hall meetings with the Corporate Management

- Speech craft programme

- LIFELINE – a programme to improve the quality of life

- “Better U” – staff development programme

In addition, to strengthen institutional knowledge and employee engagement simultaneously, the Bank organised the Battle of the Masterminds. This enjoyable series of quizzes, which culminated in June, encouraged employees to brush up on their knowledge of our business model, products and services, risk, compliance, audit, bank circulars, and current affairs in a fun environment.

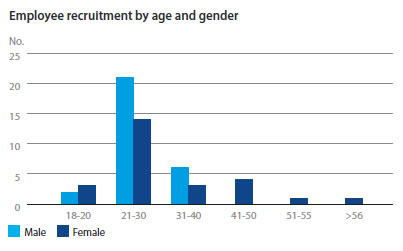

Employee recruitment and retention

While we rely on an experienced, skilled, and dedicated team of employees at all levels, our perennial problem has always been attracting employees for higher-level positions as SDB bank's position as one of the best micro-finance organisations in the country is not known to many. With current employees standing as examples and guardians of an enabling and empowering culture, the awards we have won, and the high-level employees that the Bank has attracted recently, the truth about SDB bank is becoming better known. We are now beginning to attract many high-quality candidates for higher levels. Attracting potential employees for other positions has never been a challenge.

We remain appreciative and supportive of our existing employee cadre – a true asset and the secret to our success. Although we are seen as a small organisation, our employee packages are above market average. Our employee retention levels remain relatively strong having continuous employment with the Bank.

We take care to balance the retention and development of internal talent with a healthy infusion of external talent to ensure that our employee cadre remains diverse, holding a range of different perspectives and viewpoints which reflect those of our customers and contribute to the innovation for which SDB bank is becoming known.

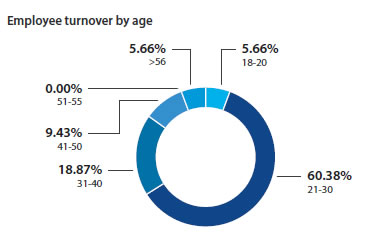

Employee turnover by grade and gender

| Grade | Total number of employees | Male | Male % |

Female | Female % |

| Senior Management and above |

3 | 1 | 0.07 | 2 | 0.14 |

| Executive staff | 15 | 4 | 0.27 | 11 | 0.75 |

| Non-executive staff | 15 | 11 | 0.75 | 4 | 0.27 |

| Managers and assistant managers | 9 | 6 | 0.41 | 3 | 0.20 |

| Other | 11 | 9 | 0.61 | 2 | 0.14 |

|

|

53 | 31 | 2.10 | 22 | 1.49 |

Performance management

Performance evaluations of employees have hitherto taken place annually and are measured against three dimensions of employment:

- Business targets or key performance indicators

- Behavioural attributes

- Value propositions

The biannual performance reviews introduced in 2018, which linked performance with incentives, training and career advancement has proved to be good for driving employee engagement. This will be an area that we will be looking to improve further in 2020 and beyond.

SDB bank is an equal opportunities employer, treating all its people and prospective employees with impartiality, irrespective of gender, age, race, or religion. This applies across all our processes from recruitment to career development and progression.

We have also created provided profiles for key management roles so that we are able to groom employees to meet the expectations that the role requires. Each employee will now also be screened by Head of HR. For managerial level positions and above the CEO will also assess them to ensure that all levels, all new hires with potential to be groomed for leadership positions. This will ensure that we are focused on the long term.

Benefits provided to employees

We recruit people whose culture and values match ours and we offer them competitive terms of employment. This leads to improved retention rates.

Every year we enhance our employee benefits. A sample of other benefits that we offer our employees includes:

- 21 days of annual leave

- Comprehensive medical insurance

- Employer’s contribution to EPF 14% (where minimum requirement is 12%)

- Medical leave of 14 days

- Unutilised annual leave of up to 7 days which can be carried forward

- Membership in the Welfare Society

- Special leave for critical illnesses

- Female employees with infants allowed feeding breaks during the first year

- Educational support: Honorarium payments for completion of banking exams and reimbursement of professional membership subscriptions

- Two years no pay leave for those who are pursuing their higher education abroad, subject to a signed bond between the employee and the employer

- Non-salary benefits introduced in 2019

Our welfare club too organises a number of initiatives which contributes towards employee engagement and retention.

Industrial relations

Freedom of association – which covers three aspects: namely an employee’s right to join or leave groups voluntarily, the group’s right to take action collectively in the interests of its members, and the association’s right to accept or decline membership based on certain criteria is an aspect that the Bank has long recognised and respected.

As an organisation bank has taken every endavour to maintain the industrial peace in the Bank.

Future outlook

The Bank has adopted a transformation agenda for 2017-2020 which necessitates changes across many areas of its operations, including its human capital. This is an ambitious three-year employee strategy which is focused on developing our people to meet the needs of the future.

One of the key focus areas of this programme relates to revenue generation through the development of Customer Value Propositions and optimisation in branches. The focus on improving performance assessments of employees and implementing a robust performance tracking system is expected to bring about a change in the attitudes, culture, and employee practices.

In the near future we will be looking to improve employee development, tailoring development programmes to suit the various roles at all levels. 2020 will see us putting our new training and development plans into action. Coaching, mentoring and counselling will also be introduced. These actions will go a long way towards ensuring that employees at all levels pull together to meet the Bank’s goals.